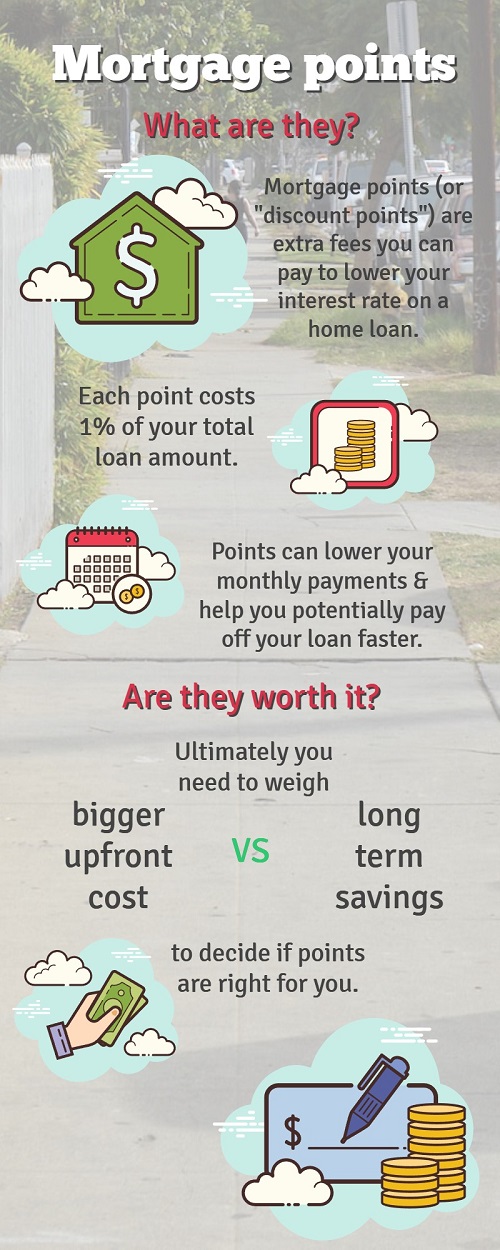

When considering the myriad choices for home financing, homebuyers might wonder, “Are mortgage points worth it?” By paying special fees to the lender, you can sometimes get a lower interest rate. However, the points are no small expense. It’s important to weigh the pros and cons before deciding.

Mortgage points, also called discount points, are fees paid by borrowers to reduce loan interest rates. Terms and conditions of different points vary from one lender to the next, but the pricing is typically standard across lenders. Each individual point costs 1% of your loan amount.

Mortgage points have the potential to significantly lower your monthly mortgage payments and help you save money in the long term. As interest rates rise, using points can be a worthwhile strategy for making your mortgage more affordable.

Lower monthly payments and a lower interest rate are excellent advantages of mortgage discount points, but what are the downsides? One major disadvantage is, to truly save money, you must stay in the home for a long enough time to reach a “break even point,” or the amount of time it will take for your savings to be greater than the amount you pay out.

If you have plans to refinance or sell your home in the near future, you may lose money on discount points by not taking full advantage of the prepaid interest.

Buying points from your mortgage lender might be worth it in some cases, but every financial situation is different. If you plan to stay in your home for the entirety of the loan term, you’ll eventually benefit from the upfront cost of points and save a large amount of money.

However, homebuying already comes with significant upfront costs, and you may not want to add another to the list. Instead, some financial experts suggest putting extra money toward a larger down payment instead, as this can also affect your interest rate in some cases.

Are mortgage points right for you? Ultimately, only you can decide. Keep these factors in mind when considering your options for home financing.

Founder, principal and managing broker of Graham-Rutledge REALTORS a boutique real estate brokerage firm, Calvin Graham has been an influencer in delivery of bespoke client-centric offerings designed to elevate the real estate experience. Since 1988 Graham's passion and dedication to his craft has earned him the distinctive title of REALTOR'S REALTOR.

Graham offers clients fresh innovative marketing strategies which empower clients with the ability to achieve desired results. Utilizing his formal studies in economic combined with extensive industry specific real estate and mortagage lending training has prepared Graham to provide clients unparalleded support with regards to their real estate needs.